TV Viewership on the rise

Television in India is the largest and the most effective medium to reach consumers. With 557 million daily tune-ins and an average of 225 minutes (Q4FY18) spent per day, the reach and engagement offered by television in India is unparalleled. Television viewership is increasing across genres and demographics, as evident from the BARC data. The growing reach of different genres indicates that increasing choices available to the audience is one of the drivers for the increasing television consumption. Multiple genres and languages enable reach to specific audience segments.

Viewership across age groups (in million impressions)

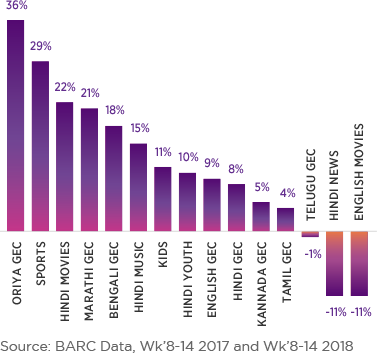

YoY change in viewership across genres

Increasing choice driving consumption

Television viewership has also seen an increase across languages, especially regional language channels. This is driven primarily by increased availability of original content in these languages. Historical data suggests that as more channels are launched in a market or the original content is increased, it leads to an increase in the content consumption, rather than cannibalisation. For example, the launch of Zee Yuva (Marathi), a youth-focused entertainment channel, and Colors Tamil (Tamil), a general entertainment channel, has led to an increase in the total viewership in the respective markets.

Move to an impression-based currency could boost the industry

In India, ad rates are linked to rating points – a percentage metric of viewership. Total rating points increase only if average television consumption per person increases. Accordingly, rating point does not reflect the expanding television universe. Over the past decade, measured universe of television audience has grown by six times. Number of impressions have grown by a similar factor to around 28,000 million per week. The 2% CAGR in rating points does not capture the 30% CAGR witnessed in impressions over the past five years. Though the cost of advertising per rating point has been rising, cost per impression has actually seen a decline. Similar to the global practice, India would eventually move to an absolute metric like cost per impression. This would enable broadcasters to monetise the sharp growth in viewership.

TRAI tariff order – Uncertainty continues

TRAI released the tariff order in March-2017 with an objective to allow viewers to choose channels on an a-la-carte basis. The order was supposed to be implemented from May-2017, but was challenged by multiple stakeholders. Of the two cases filed against the order, one was being heard by the Madras HC. After a split verdict by a two-judge bench in March-2018, the case was referred to a third judge who upheld the validity of the order except for one clause. As per the clause, in a content agreement between broadcaster and distributors, a bouquet of channels cannot be priced at less than 85% of the sum of a-la-carte price of these channels. The court found this provision to be arbitrary and hence not enforceable. Effective implementation of this order requires a significant upgrade of infrastructure and subscriber management systems of the distributors. Given the low ARPUs in India, it might be difficult to offer channels on an a-la-carte basis to every consumer. As a result, bouquet may remain the most popular option for subscription even under the new regulation.

DD Freedish - Policy under review

DD Freedish, the state - owned distribution platform offering free to air(FTA) channels to subscribers, has been an important driver for reaching new audience segments, primarily in rural areas.This increased reach, along with measurement of rural audience, has improved monetization of FTA channels.Most of the leading broadcasters have FTA channels which largely run on the library content.Freedish had a process to auction slots to broadcasters to air their FTA channels.However, during the year, the Ministry of Information and Broadcasting (MIB) has put auctioning of slots on hold as it is reviewing the existing policy.Channels already on the platform continue to run until the new policy is announced.

Domestic Broadcast Business Review

Domestic Broadcast Leadership Team

In its 25th year, the Domestic Broadcast Business was the #1 entertainment network of the country. During the year, ZEEL saw a 200 bps improvement in its market share and reached an all India viewership share of 18.0%. This increase in viewership was driven by the improved performance of our flagship channel Zee TV, increased traction of some regional channels, and the integration of the two channels acquired from RBNL.

Brand refresh

During the year, the network adopted a refreshed brand identity with new logos for all the channels. Some of the channels were also relaunched with a new brand proposition. Our new brand identity gives a unified look and feel to the network, while bringing the corporate brand philosophy of ‘Extraordinary Together’ to life. The initiative was accompanied by iconic 360o marketing campaigns, enhancing the brand equity and brand recall significantly.

Cluster wise Operational Review

Hindi General Entertainment

The Hindi GEC bouquet contains 6 channels - Zee TV is the flagship channel, &tv is the Company’s second GEC targeted at urban audience, Zee Anmol and Big Magic are the FTA channels catering to the rural viewers.

Zee TV was the #1 Hindi GEC during the year. After a weak performance in FY17, the channel exhibited an impressive turnaround across all the parameters. With a 200 bps increase in market share, top two shows in fiction category, and the two biggest fiction launches of the year, Zee TV has been on a continuous growth trajectory. On its 25th anniversary, the channel unveiled its new brand promise of ‘Aaj Likhenge Kal’ to bring to its audience stories that inspire ordinary people to do extraordinary things.

&tv’s market share was largely flat during the year. In the context of increase in competitive intensity on account of one major competitive channel taking the FTA route and increased content investments by most competing channels, the performance of the channel was satisfactory. The channel aims to increase loyalty amongst the urban audience with its differentiated programming initiatives.

Zee Anmol was the #1 channel in the FTA genre with leadership in 42 weeks. Big Magic improved its market share in the segment.

Hindi movie cluster

ZEEL’s Hindi Movie cluster comprising 7 channels - Zee Cinema, &pictures, Zee Classic, Zee Action, Zee Anmol Cinema, Zee Cinema HD and &pictures HD, continued to maintain its #1 position during the year. Besides performing well on library titles, the channels also aired world television premieres of hit Bollywood movies such as Dangal, Toilet – Ek Prem Katha, Secret Superstar and Raees. With the acquisition of movie library rights, including future rights and rights of movies under production, the Hindi Movie cluster has strengthened its catalogue which should provide an impetus for growth.

Regional entertainment channels

Regional GECs continued their strong performance and strengthened their competitive position in respective markets. ZEEL’s regional portfolio caters to 7 linguistically diverse markets - Marathi, Bengali, Kannada, Telugu, Tamil, Oriya and Bhojpuri.

Zee Marathi continued to be the #1 channel garnering a majority share in the Marathi markets. Zee Yuva, the only Marathi channel in the youth entertainment space, became the third highest channel by reach and helped grow the network’s share in the Marathi market.

Zee Bangla was the #2 channel during the year. It gained significant share in the fourth quarter to become the leader in the urban market. While consolidating its urban reach, the channel has also undertaken ground connect events to increase its rural viewer base, which are yielding results.

Zee Tamil, the #3 channel, continued on the growth trajectory witnessed in FY17, and ramped up its market share in each of the quarters. The channel’s fiction shows have shown a significant improvement in ratings, which provide a solid foundation for building loyal viewership. The channel was relaunched with the proposition of ‘Let’s bridge hearts and welcome change’, appealing to both the young and old generations. During the year, it continued to narrow the gap with the second ranked channel.

Zee Telugu was the #1 channel in the urban market. Launch of new properties and afternoon band helped the channel further consolidate its leadership. The channel also garnered the highest-ever weekly rating by a Telugu channel in the urban market.

Zee Kannada maintained its position as the #2 channel and continued to be the leader in the non-fiction programming genre. The channel strengthened its fiction programming, which drove its performance.

Zee Sarthak continued to be the #1 channel by a distance, being the leader across most of the prime-time slots.

Big Ganga was the #1 Bhojpuri general entertainment channel.

Regional movie cluster

Zee Talkies continued to be the #1 movie destination for the Marathi audience. Along with premiering the best Marathi movies, the channel’s non-film programming initiatives have helped maintain its second position amongst all Marathi channels, in terms of reach and viewership, just behind Zee Marathi.

Zee Bangla Cinema, the #2 channel, improved its market share driven by a good selection of movies and ZBC Originals. The channel focused on building its reach on the back of 360o campaigns for the blockbuster movies and aims to be the preferred destination for Bengali movies.

Zee Cinemalu, in its second year of operations, was the #3 most-watched Telugu movie channel. As the only Telugu movie channel airing World Television Premieres, it is quickly ramping up to challenge the established players.

Niche channels

Zee Café was the second most-watched English entertainment channel with an eclectic content catalogue. True to its brand promise of ‘All Eyes on New’, it continued to bring the latest English shows from around the world to the audience.

&privé HD, our new channel in the English premium movie segment, quickly climbed to the leadership position and has been the #1 channel since its launch.

Zee Studio, our English movie channel, performed well during the year. The channel was recently renamed &flix with a new brand proposition of ‘Leap Forth’. With a total of 400+ movies in its library and 52 premiers, it will give a larger-than-life experience to the audience.

Zing maintained its position as one of the leading youth entertainment channels with a mix of music and Bollywood based shows.