MANAGEMENT DISCUSSION AND ANALYSIS

INDIAN

MACROECONOMIC

SCENARIO

INDIA’S M&E INDUSTRY IS PROJECTED TO GROW AT MORE THAN DOUBLE THE PACE OF GLOBAL AVERAGE

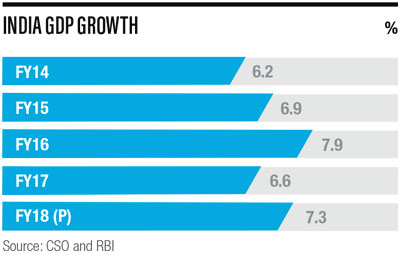

India remains one of the fastest growing economies in the world despite the temporary slowdown in growth due to government’s decision to withdraw high denomination notes from circulation. High frequency data, such as automobile sales, cement consumption, personal loan growth and exports growth suggest that the economy is gradually recovering from the impact of demonetisation. RBI expects real GDP growth to accelerate to 7.3% in FY18 from 6.6% in FY17 (GVA basis). Sustained low inflation, falling fiscal deficit, low current account deficit, and a stable currency have created a positive environment for economic growth. Goods and Services Tax (GST) is expected to be implemented in India in FY18. This unified tax regime, coupled with the Central Government’s thrust on areas, such as power, infrastructure, and affordable housing should help accelerate India’s growth rate closer to 8% in the medium term.

India’s consumption growth over the past decade has been strong and resilient even during periods of slower GDP growth. This bodes well for our industry, as spends on media and entertainment are linked to consumption spends in the economy. Private final consumption is estimated to have grown at 6.8% CAGR over FY12- 17 in real terms (12.5% in nominal terms). Within the consumption basket, the share of non-food items has been rising with increasing per capita income. There is another positive trend of organised businesses entering and gaining market share in various sectors. Both these factors bode well for growth in advertising spends.

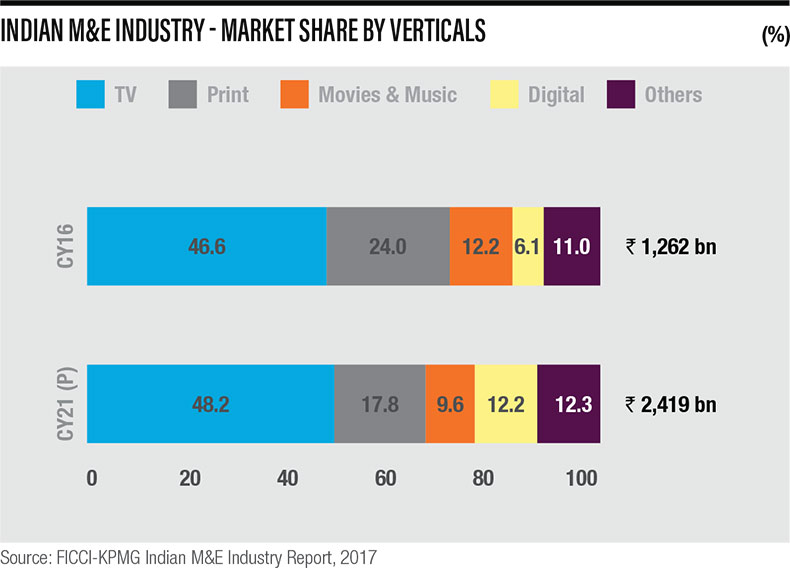

INDIA’S MEDIA AND ENTERTAINMENT INDUSTRY

The media and entertainment industry (M&E) witnessed another year of all round growth, albeit slower than estimates at the start of the financial year. This was mainly due to the impact of demonetisation. According to FICCI-KPMG estimates, India’s M&E industry grew at 9.1% in CY16 over the previous year, to ` 1,262 billion. On average, an Indian consumer spends much less time and share of his disposable income on media and entertainment consumption, compared to peers and developed countries. This provides a significant headroom for sustained growth which will be driven by rising disposable incomes and increasing avenues of entertainment. FICCI-KMPG industry report pegs the growth of Indian M&E industry over the next five years at 13.9% CAGR, to ` 2,419 billion.

In the year gone by, within the television segment, regional channels continued to gain traction. Print, unlike in the developed world, continued to grow, with vernacular outpacing the growth of English language publications. In the movie industry, although overall revenues declined, box office collections of blockbuster films surpassed all previous records. This was true for Bollywood as well as regional films. Video consumption on digital platforms got a boost due to decline in data tariffs and increased availability of content on various digital platforms. Radio made deeper inroads in semi-urban India following the auction of Phase III licenses.

TELEVISION

INDIA’S LOW AD SPENDS AND TELEVISION PENETRATION PRESENTS A MULTIYEAR GROWTH OPPORTUNITY; TELEVISION SECTOR IS PROJECTED TO GROW AT 14.7% OVER THE NEXT FIVE YEARS

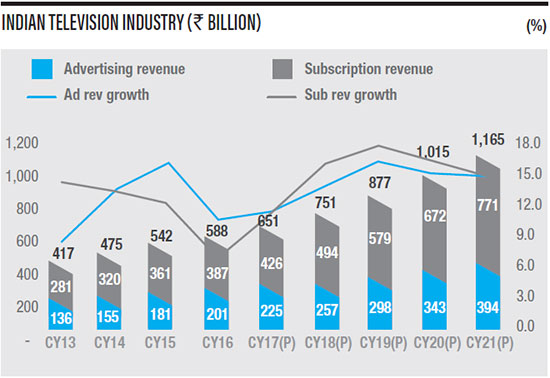

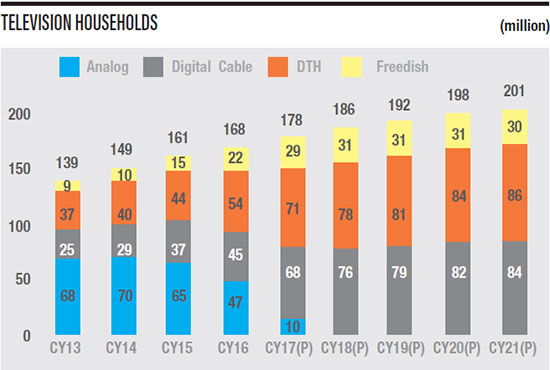

Television industry’s growth in FY17 saw a temporary blip because of demonetisation and delay in digitisation of analogue cable subscriber base. However, towards the end of the year, advertising growth returned to normalcy. After multiple extensions of deadline, digitisation of Phase III cable subscriber base was largely completed. Despite these adversities, as per the FICCI-KPMG industry report, Indian television segment registered a growth of 8.5% in CY16 as compared to 14.2% in CY15.

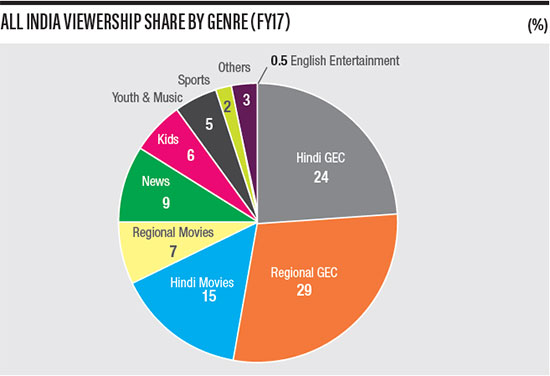

Television remains the prime medium of entertainment for the Indian consumer. During FY17, time spent on watching television at individual and household levels stood at 158 and 287 minutes per day respectively, which remained stable through the year. During the year, there was an increase in viewership of news channels due to significant events, such as surgical strikes, state elections and demonetisation. Hindi GEC remains the most watched genre in the country. Meanwhile, regional channels continued to gain traction.

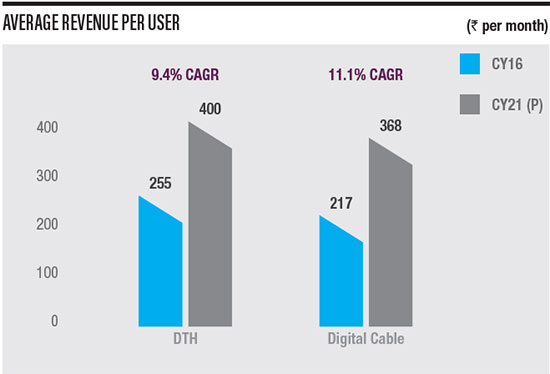

The deadline for digitisation of Phase III and IV were postponed again to January 2017 and March 2017, respectively. On the positive side, digitisation of Phase III is now almost complete. Despite the deadline for phase IV having elapsed, the pace of digitisation in those areas remains slow due to its geographical spread. Both, broadcasters and distributors, are focused on improving monetisation of subscribers in newly digitised markets. In India, pay television ARPU (Average Revenue Per User) is significantly lower than comparable countries. Completion of the digitisation process could set the ball rolling for long overdue correction of Indian television ARPU.

Source: FICCI-KPMG Indian M&E Industry Report, 2017

Source: FICCI-KPMG Indian M&E Industry Report, 2017

During the year, Telecom Regulatory Authority of India (TRAI) issued tariff order with the objective of allowing viewers to choose channels on an a-lacarte basis. This order has been challenged by multiple stakeholders and the matter is subjudice. Effective implementation of this tariff order requires a significant upgrade of infrastructure and subscriber management systems of the distributors. It might be difficult to offer channels on a-la-carte basis, given low ARPU in India. As a result, bouquet may remain the most popular option for subscription even under the new regulation.

Broadcast Audience Research Council’s (BARC) television universe expanded from 674 million individuals and 153 million households to 780 million individuals and 183 million households in FY17. It is in the process of increasing panel size from 22,000 meters to over 30,000 by the end of CY17. The measurement of rural audience has provided valuable insights into the viewership patterns and preferences of vast rural television households.

Growth outlook for the Indian television segment is strong across both advertising and subscription revenue streams. Strong consumption growth, coupled with increasing share of organised businesses in various segments, augurs well for the growth in advertising spends. On account of its reach and impact, television will continue to remain the preferred advertising medium for brands. Digitisation, increasing penetration of high definition and a growing base of television households will drive subscription revenues. FICCI-KPMG report forecasts Indian television segment to grow at a CAGR of 14.7% over CY16-21, driven by 14.4% growth in advertising revenues and 14.8% growth in subscription revenues.

ZEEL has a strong presence in all entertainment genres in both national and regional markets through a bouquet of 32 channels. During FY17, the Company’s pan-India viewership share was 16.0%.

Source: BARC

Source: FICCI-KPMG Indian M&E Industry Report, 2017

MOVIES

PROLIFERATION OF MULTIPLEXES IS ONE OF THE KEY DRIVERS FOR MOVIE INDUSTRY REVENUE GROWTH

India is the world’s largest market in terms of movies released annually but ranks fifth in terms of revenues. Although movie-going is a well-entrenched leisure habit in India, its monetisation is low due to smaller ticket size and low screen penetration. However, the scenario is improving, with multiplexes increasing its share at the expense of single screens, driving up average ticket prices. Satellite and digital rights are additional sources of revenue for the movies. While the market for satellite rights remains healthy, digital rights saw a sharp increase in price due to competition from multiple players.

While the South Indian film industry continues its strong growth, other regional markets such as Marathi, Gujarati and Punjabi are also gaining traction. For instance, Sairat, a Marathi movie, grossed more than ` 1 billion in theatrical revenues, a first for a Marathi movie. The Indian movie industry is estimated to grow at 7.7% CAGR during CY16-21 to around ` 207 billion.

Zee Studios, ZEEL’s film production and distribution arm, is well positioned to gain from these market dynamics. It produces Bollywood as well as regional language films in Marathi, Kannada, Telugu and Punjabi.

DIGITAL

IN INDIA, MOBILE WILL LEAD THE WAVE OF ONLINE VIDEO CONSUMPTION

During the year, the ecosystem for digital consumption of entertainment content evolved at a fast pace. In India, mobile is the primary device for internet access. According to estimates, India’s 3G and 4G subscriber base stood at 250 million at the end of FY17, and is likely to reach 470 million by 2020. The launch of Reliance Jio and acceleration in 4G rollout by other telecom players has significantly improved data connectivity. Over the past few years, there has been a spurt in the number of OTT service providers, with both the local as well as foreign players vying for consumers’ attention. OTT players are also investing in producing original content for digital platforms, including digital only or digital first content.

Rollout of 4G networks and the fierce competition in the telecom sector has led to a sharp decline in data rates. Online consumption of video content has surged on the back of these developments and the trend is likely to continue. Despite the drop, because of low pay television ARPU, the total cost of watching video online still compares unfavourably with television. Low penetration of wired broadband is another limiting factor for wider adoption of online entertainment. As broadband availability and affordability improves further, the growth in online video consumption will accelerate. Ad spends on digital media is growing at an impressive pace, partially driven by ‘search’ and ‘banner’ advertising. The FICCI-KPMG report shows that digital advertising in India grew by 28% in CY16 to ` 77 billion, and is expected to grow at a CAGR of 30.8% over CY16-21.

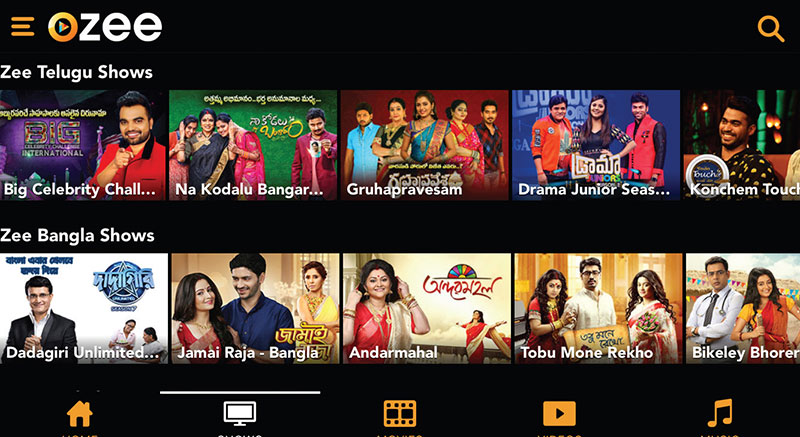

ZEEL has a strong presence in the digital space through its two OTT platforms – dittoTV, which is a subscriptionbased video on demand (SVOD) platform, and OZEE, which is an advertising video on demand (AVOD) platform.

MUSIC

DIGITAL MUSIC STREAMING HAS GIVEN A NEW LEASE OF LIFE TO THE INDUSTRY

Indian music market is set to more than double to ` 25 billion by CY21. Music labels’ revenues are derived from multiple sources, such as online music streaming, airing on radio, and use of audio tracks for various purposes. With the onset of digital revolution, music consumption on digital platforms has become the primary driver of growth for the industry. It now contributes to over 70% of the total revenues. Online streaming platforms already have over 50 million users which will continue to grow on the back of falling data cost and availability of curated music. Like the trend in movies, music consumption in regional languages is also gaining traction.

Zee Music Company, ZEEL’s music publishing label, has a significant presence in Bollywood music as well as regional music.

LIVE EVENTS

The live events industry in India is largely unorganised. Traditionally, India has not been a big market for ticketed live events, but the space is now witnessing a strong growth. It could further accelerate if issues such as lack of infrastructure, skilled manpower, and multiple taxes are resolved. As per the FICCI-KPMG report, live entertainment industry in India grew at 20-25%, with an estimated revenue of ` 55-65 billion in CY16.

ZEE LIVE is the live events business division of ZEEL and it creates intellectual property (IP) for events including music concerts, food festivals and plays amongst others.

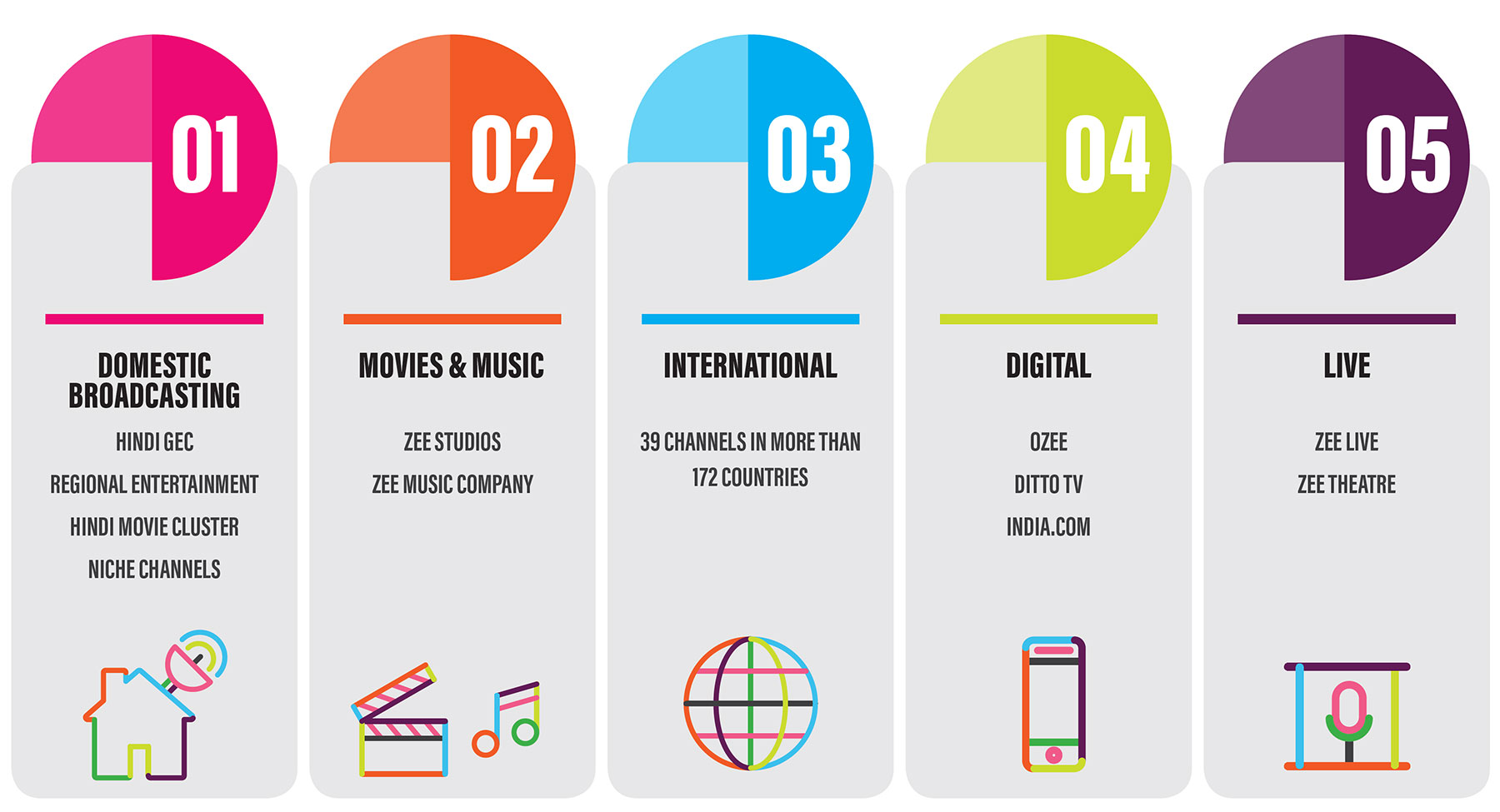

COMPANY PROFILE

Enterprises Limited (ZEEL) is one of India’s largest entertainment content company. Starting with the launch of India’s first Hindi satellite channel, Zee TV, in 1992, ZEEL has evolved into an integrated entertainment content company over the last two and a half decades. The Company caters to the entire spectrum of customers’ entertainment needs with production of content across different formats and platforms, such as fiction and reality shows for television, movies, music, digital, plays and live events. ZEEL produces content in more than 10 languages in India to serve the linguistically diverse audience. It has also established its presence in over 172+ countries and produces content in 9 foreign languages. Over the years, the Company has built a content library of 240,000+ hours reaching over a billion viewers globally.

ZEE ENTERTAINMENT ENTERPRISES LIMITED

OPERATIONAL REVIEW

IN FY17, ZEEL STRENGTHENED ITS POSITION AS THE NO. 2 PLAYER AND NARROWED GAP WITH THE LEADER

BROADCASTING

Domestic Broadcasting is ZEEL’s largest business division comprising 32 channels across four categories - Hindi GECs, Hindi Movie Cluster, Regional Entertainment Channels and Niche Channels.

During FY17, the domestic broadcasting business continued to perform strongly. ZEEL had a network viewership share of 16.0% and was the second largest player in the Indian television entertainment business. The performance was led by a good performance of the regional portfolio and Hindi movie cluster.

The year was also marked by multiple decisions that reflect the Company’s commitment to continue investments for growth and to further strengthen its competitive position.

KEY HIGHLIGHTS

The Company’s sports business - Ten Sports Network, was divested through a sale to Sony Pictures Network for USD 385 million. The decision to sell the business was a culmination of strategic review of the portfolio. The Company invested in and grew the sports business over the last 10 years with the expectation of turning it profitable. However, the gestation period continued to get elongated as monetisation of sporting events did not improve as expected. Meanwhile, the cost of broadcasting rights of relevant sporting events continued to escalate.

ZEEL agreed to acquire the television broadcasting portfolio of Reliance Broadcast Networks Limited (RBNL), which comprises of two channels - Big Magic and Big Ganga. These acquisitions dovetail into ZEEL’s well established strategy of regionalisation and segmentation. The acquisition offers multiple synergies with the existing offerings of ZEEL. Big Magic complements the existing Hindi GECs through the addition of comedy genre, and Big Ganga opens up the attractive Bhojpuri market for the Company.

Zee Yuva, launched in August 2016, is a youth focused Marathi channel that caters to contemporary audiences and will help the Company consolidate its leadership position in the language.

- Zee Yuva, launched in August 2016, is a youth focused Marathi channel that caters to contemporary audiences and will help the Company consolidate its leadership position in the language.

- Zee Anmol Cinema, launched in September 2016, builds on the leadership of hindi movie cluster by adding an FTA property. The channel will allow consumers to sample premium content and graduate to a paid model over a period.

- Zee Cinemalu, was launched in September 2016 for the movie loving Telugu audience. The channel leverages a library of over 500 titles across genres to cater to the preferences of a diverse set of audiences.

- Considering the viewer preference for content on Zindagi and ZeeQ, the Company decided to shut down linear feed of these channels. The content of these two channels is available on Company’s online platform.

KUMKUM BHAGYA WAS THE HIGHEST RATED WEEKDAY PRIME-TIME SHOW ACROSS TIME-SLOTS

During the year, the Company significantly increased its investments in acquisition of movie rights including future rights and rights of movies under production. Movies is one of the most important entertainment genres for Indian consumers and a key long-term growth driver for the business. ZEEL now has a portfolio of 11 movie channels across Hindi and regional languages. Movies also form an integral part of content strategy for general entertainment channels across languages.

PORTFOLIO

With the improving penetration of HD television sets, audience increasingly wants to consume content in high definition. During the year, the Company expanded its HD offerings with the launch of HD feeds for Zee Marathi, Zee Talkies and Zee Bangla. HD channels offer a richer viewing experience to consumers and higher ARPU to the Company. ZEEL will continue to increase its HD offerings going forward.

CLUSTER WISE OPERATIONAL REVIEW

HINDI GEC

The Hindi GEC bouquet contains 4 channels - Zee TV is the flagship channel, &tv is the Company’s second GEC targeted at younger and urban audience, Zee Anmol is the FTA Channel and Zing focuses on the youth audience.

Zee TV is one of the leading Hindi GECs in India. While the channel began the year on a strong note, it witnessed a dip in its viewership during the later half. The channel has put together a new content line up to win back share of eyeballs which has started yielding results.

&tv continued to build its viewership in urban markets and has launched several shows that are designed to help increase audience stickiness and attract new viewers.

Zee Anmol was the leader in the FTA genre during the year, and Zing maintained its position amongst the top two channels in the youth genre with a mix of music and Bollywood shows.

HINDI MOVIE CLUSTER

ZEEL’s Hindi Movies bouquet, comprising 7 channels (Zee Cinema, &pictures, Zee Classic, Zee Action, Zee Anmol Cinema, Zee Cinema HD and &pictures HD), continued to consolidate its leadership position during the year. Besides performing well on library titles, the channels also aired world television premieres of hit Bollywood movies, such as Welcome Back, Rustom, Flying Jatt, Baaghi, Tamasha and Baar Baar Dekho.

NICHE CHANNELS

Zee Café remained one of the top English entertainment channels, with its rich and diverse content spread. Zee Studio, with its top-of-line Hollywood content, continued to be one of the preferred English movie channels across the genre. Zindagi, through its thought leadership, aired some of the most compelling stories from culturally diverse regions such as Turkey, South Korea, Ukraine and more. However, considering the preference of the viewers for this channel, the Company decided to move its content to the online platform.

REGIONAL ENTERTAINMENT CHANNELS

ZEEL’s regional portfolio caters to 6 linguistically diverse markets - Marathi, Bengali, Kannada, Telugu, Tamil and Odiya. Completion of acquisition of RBNL’s Broadcasting business will add Bhojpuri language to the portfolio. Regional GECs continued their strong performance and strengthened their competitive position in respective markets.

Zee Marathi strengthened its leadership and was the No.1 channel across all prime-time slots. Zee Yuva was launched this year with impressive numbers – it became the third highest channel by reach within six months of its launch. Zee Talkies continued to be the top movie destination for Marathi audience.

Zee Bangla maintained its No. 2 position during the year. While consolidating its urban reach, the channel also took steps to increase its rural viewer base, which demonstrated results. Zee Bangla Cinema improved its viewership share as the No. 2 movie channel helped by the high viewership of Zee Bangla Cinema Originals movies.

Zee Kannada established itself as the clear No. 2 channel, and recorded its highest viewership ever, with an increase of 40% in ratings compared to last year.

Zee Telugu was the No. 3 channel in the market. However, it maintained its leadership in the primetime slots. Zee Cinemalu made an impressive debut and became the third most watched Telugu movie channel within six months of launch.

Zee Tamil increased its viewership share by 300% and became the No. 2 channel. The channel has lined up multiple launches which are likely to provide an impetus to the viewership numbers.

Sarthak TV (Odiya) continued to remain the leading channel by a distance, being a leader across most of the prime-time slots.

MOVIES

AND MUSIC

The Movies and Music businesses significantly scaled-up their operations in FY17. Both businesses performed well during the year driven by several marquee properties. These businesses have now started to contribute to overall growth of the Company.

ZEE STUDIOS

During the year, Zee Studios released seven movies across three languages. Zee Studios has adopted a strategy of focusing on Hindi and regional movies, which allows it to leverage its expertise in making content in several languages.

2 OF OUR MOVIES JOINED THE ` 1 BILLION CLUB

ZEE STUDIOS’ BUSINESS APPROACH

SCRIPT DRIVEN

Movie selection at Zee Studios starts with identifying thought provoking story-lines and does not revolve around star cast. For instance, Sairat featured two unknown faces but still managed to attract audience on the back of a strong story. Zee Studios’ complete involvement in movie making sets its business model apart from several other studios. This gives the Company a strong grip over story-line, execution and costs.

ACROSS BUDGETS, ACROSS LANGUAGES

The Company does not believe that the success of a movie is contingent on the budget. A good story rather than budget is a pre-requisite for selection of a movie. Producing movies across different budgets also reduces the risk. Leveraging its experience of entertaining viewers across languages, the Company makes movies in multiple languages. A portfolio of movies across budgets and languages reduces inherent risk in the business.

PROFIT-SHARING WITH KEY TALENT

Talent is a significant proportion of the movie cost in India and in many cases, this high cost could be the difference between a profitable and a loss making movie. The Company works on the principle that if a movie is successful, all stakeholders should make money. Accordingly, it tries to engage the talent on a profit sharing basis. This also reduces financial impact of unsuccessful movies.

LEVERAGE PRESENCE ACROSS VERTICALS

A strong portfolio of movie channels, music label and digital platforms enables the Company to improve its viewership and monetisation of movies. Understanding from these businesses is used in conceptualising and producing movies, which also improves potential for success. Presence across mediums enables the Company to do 360° promotion of movies.

KEY HIGHLIGHTS

- In FY17, Zee Studios released 7 movies across 3 languages of which 4 were produced while 3 were distributed.

- Rustom, a poignant real life story adapted for cinematic storytelling was released in August 2016, and received high critical acclaim. It went on to become one of the highest grossing films of the year. Akshay Kumar, the male lead, received the National Film Award for Best Actor for his performance in the film.

- Sairat, the record-breaking Marathi film, grossed more than `1,000 million in box office collections, and became the only Marathi film ever to cross this milestone. The female lead – Rinku Rajguru, received a special mention from the jury at National Film Awards 2016, for her effective portrayal of a lively girl who defies societal norms and faces her family’s wrath in pursuit of her dreams.

Strong slate for the future

Zee Studios has an impressive line-up of Bollywood releases including Mom (starring Sridevi), Secret Superstar (starring Aamir Khan), Kareeb Kareeb Single (starring Irfan Khan) and Tadka. In addition to this, several regional movies (in Marathi, Punjabi and Telugu) are also lined up for release. Zee Studios is also working on an international title – Beyond The Clouds, directed by Oscar nominated film maker Majid Majidi.

ZEE MUSIC COMPANY

Zee Music Company (ZMC) enjoys a significant advantage in music business due to Company’s presence in music broadcasting and digital. ZMC continued its aggressive content acquisition strategy and emerged as a leading player with an incremental market share of over half the new releases in Bollywood. It also deepened its footprint in regional music markets - Marathi, Punjabi, Kannada, Telugu, Gujarati and Bengali.

KEY HIGHLIGHTS

- During FY17, ZMC acquired the music rights of more than 143 movies including 58 Bollywood movies. Some of the key titles acquired include Half Girlfriend, Dangal, Raees, Baar Baar Dekho and Flying Jatt.

- ZMC is the fastest growing music label on digital platforms with a 15% market share (#2 music label).

- The ZMC YouTube music channel has more than 6.7 million subscribers, making it the second most popular Indian YouTube channel in the music category.

- ZMC’s content garnered an average of 750 million views per month on YouTube in the last quarter of FY17.

ZMC NOW HAS MORE THAN 6.7 MILLION SUBSCRIBERS ON YOUTUBE

Zee Music Company’s album ‘Udta Punjab’ is awarded ‘Album of 2016’ by Apple Music & iTunes

INTERNATIONAL

BUSINESS

ZEEL now operates in more than 172 countries with telecast of its content in 19 languages, including 9 foreign languages. Its international reach has expanded to 363 million – a growth of 29% over FY16. This makes ZEEL a truly global entertainment content provider.

ZEEL has a two-pronged strategy for international markets – reaching the Indian and South Asian diaspora with channel offerings in Indian languages and serving the non-Indian audience in their native languages. The Company aims to serve Indian diaspora through addition of new channels and distribution platforms. To increase its presence among non-Indian audience, the Company seeks out markets with cultural and entertainment preferences similar to its home market.

KEY HIGHLIGHTS

- ZEEL launched 5 channels in local languages across various geographies – Zee Sine in Philippines (Tagalog), Zee One in Germany (German), Zee Mundo in US (Spanish), Zee Bollynova in Africa (English), Zee Bollymovies in Africa (English).

- The Company launched a Hindi radio station 106.2 FM in the UAE.

- ZEEL also produced local content in few of its markets. Shows like Dance Singapore Dance, Khwaabon Ke Darmiyan (Middle East) and Make It Snappy (Thailand) were produced locally.

REGION-WISE OPERATING HIGHLIGHTS

USA

Zee Mundo became the first Spanish language Bollywood movie channel in the USA.

ZEEL became the largest South Asian broadcaster in the region with 25 channels on Dish.

ZEEL also launched its Arabic channels - Zee Alwan and Zee Aflam. These launches will help the Company cater to broader cross-cultural audience of the country.

EUROPE

Zee One, launched in July 2016, became Germany’s first Bollywood channel in German.

Zee Russia saw a marked improvement in its subscribers.

&tv consolidated its position in the UK with airing of exclusive movies.

MENAP

Zee Aflam continued to be the third most watched Arabic movie channel, with 40% increase in male viewership.

Zee Alwan improved its viewership with an impressive line-up of Arabic shows.

Zee TV and Zee Cinema continued to maintain their strong leadership position in their respective target segments.

AFRICA

ZEEL launched Zee Bollymovies, a channel with Bollywood movies dubbed in English. It also launched Zee Bollynova, a GEC with English serials and food shows.

Zee World consistently retained its position as one of the top-3 most watched pay channels in South Africa, recording a 40% rise in viewership over FY16.

Zee Magic, the French dubbed GEC, gained traction among African Francophone viewers.

APAC

Zee Sine and Zee Phim were launched in Philippines and Vietnam, respectively. These channels will telecast Bollywood movies dubbed in native languages.

Zee Bioskop was relaunched in Indonesia with a content mix of Bollywood blockbusters and premium Hindi shows.

DIGITAL

ZEEL has presence in digital space through two OTT platforms – OZEE and dittoTV, and a suite of websites operated by India Webportal Pvt. Ltd. (IWPL).

OZEE

OZEE, Advertising Video on Demand (AVOD) OTT platform, showed strong growth during the year and firmly established itself as the go-to destination for all ZEEL’s on-demand content. Offering viewers the convenience of being able to watch their favourite shows across top national and regional channels, anytime, anywhere, OZEE today has a strong loyal audience base. The platform offers viewers ‘Behind the Scenes’ preview of ZEEL’s popular shows. During the fourth quarter of FY17, the platform witnessed an average of more than 50 million video views per month.

DITTOTV

During the year, dittoTV – the Subscription Video-on- Demand (SVOD) platform, was relaunched with reduced subscription price. This allowed affordable access to television to anyone who had an internet connected device. dittoTV built strong alliances with key telecom operators like Airtel, Vodafone, Idea and BSNL. The dittoTV app, which is now integrated with the platforms of these telecom operators, saw a strong growth in subscriber base. These alliances give access to subscribers in smaller towns, which are likely to drive the next wave of digital consumption.

The #BeesKaTV campaign rolled out in July 2016 trended at the No.1 position in India on Twitter on the launch day.

IWPL

IWPL runs a suite of websites focusing on entertainment, news and sports content. IWPL network registered more than 40% increase in its number of unique users during FY17. While india.com is the flagship website, TheHealthSite.com, Bollywoodlife.com and BGR.in are leaders in their respective categories.

KEY HIGHLIGHTS

- OZEE recorded over 60 million monthly video views during March 2017.

- dittoTV partnered with leading telecom operators like Airtel, Idea, Vodafone and BSNL to reach a vast subscriber base.

- India.com sites registered 42.1 million unique users in March 2017.

dittoTV IS NOW INTEGRATED WITH INDIA’S MAJOR TELECOM OPERATORS’ PLATFORMS

LIVE EVENTS

ZEE LIVE focuses on creating memorable on-ground experiences for audiences in the country as well as overseas. It aims to become the gateway for Indian live experiences to the world, while bringing the best of the world to India. Through Zee Theatre, it aims to revive, restore and spread the rich cultural heritage of theatre and bring together some of the finest works for the audience to experience. With stories across genre, from drama and musical to classics, comedy, horror and satires, Zee Theatre believes there is something for everyone.

During the year, ZEE LIVE rolled out its first two properties. Baleno Wicked Weekends created India’s longest party marathon at the biggest hotspots across six cities. Featuring some of the most popular independent artists in India, it has created a strong connect with the young urban audience. Zee Theatre, kick started theatre tour in January 2017 and staged 13 plays across 9 cities in India. ZEE LIVE is looking forward to an exciting calendar of IPs for the upcoming year

ZEE THEATRE PERFORMED 13 PLAYS ACROSS 9 CITIES SINCE JANUARY 2017

FINANCIAL REVIEW

STANDALONE

FINANCIALS

A. RESULTS OF OPERATIONS

Non-Consolidated Financial Information for the Year Ended 31 March,

2017 compared to the Year Ended 31 March, 2016.

TOTAL REVENUE

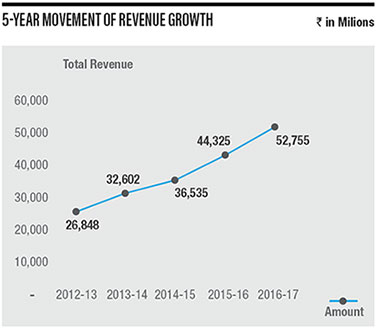

Total revenue increased by ` 8,430 million or 19% from ` 44,325

million in FY 2016 to ` 52,755 million in FY 2017. This growth was

driven by an increase in broadcasting revenue.

Revenue from Operations

The Company’s operating revenue increased by ` 7,219 million or

17%, from ` 42,065 million in FY 2016 to ` 49,284 million in FY

2017. Among the major sources of income, advertising revenue

has increased by 12% to ` 32,395 million in FY 2017, as against

` 28,831 million in FY 2016. Subscription revenue has recorded a

growth of 31% by ` 3,296 million, from `10,771 million in FY 2016

to ` 14,067 million in FY 2017.

Interest and Other Income

Interest and other income has increased by ` 1,211 million i.e. 54%,

from ` 2,260 million in FY 2016 to ` 3,471 million in FY 2017. This

increase is primarily due to dividend income received during the year.

Total Expenditure

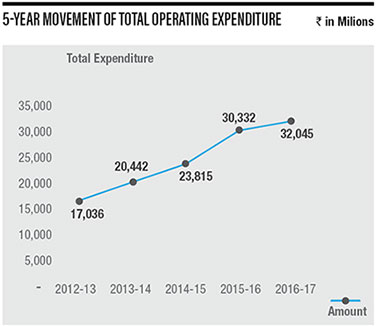

Total operational expenditure increased by ` 1,713 million or 6%, from

` 30,332 million in FY 2016 to ` 32,045 million in FY 2017. It

represents 61% of total revenue in FY 2017, compared to 68% in

FY 2016.

Operational Cost / Cost of Goods

Operational cost increased by ` 1,661 million or 9%, from ` 18,298

million in FY 2016 to ` 19,959 million in FY 2017. This increase is

primarily due to higher programming cost.

Employee benefits expenses

Employee benefits expenses have decreased by `135 million i.e. 5%,

from ` 3,106 million in FY 2016 to ` 2,971 million in

FY 2017.

Other expenses

Other expenses have marginally increased by ` 187million or 2%,

from ` 8,928 million to ` 9,115 million.

Operating Profit

The Company’s operating profit increased by ` 5,506 million, or

47%, from ` 11,733 million in FY 2016 to ` 17,239 million in FY 2017. The operating margin is at 35% for FY 2017. Increase in

operating profit is mainly due to increase in broadcasting revenue

coupled with a strong control on operational costs.

Finance Cost

Finance cost has decreased by ` 222 million to ` 1,264 million in FY

2017 from ` 1,486 million in FY 2016.

Depreciation and Amortisation

Depreciation increased by ` 172 million or 29%, from ` 599 million

to ` 771 million. Increase in depreciation is mainly on account of

depreciation on additions during the year.

Exceptional item represents gain on transfer of entity equity stake

held in wholly owned subsidiary viz. Taj Television (India) Private

Limited.

Profit before Tax and exceptional items

Profit before tax increased by ` 5,187 million or 46% from ` 11,299

million in FY 2016 to ` 16,486 million in FY 2017. The increase is

attributable to strong growth in revenues coupled with operational

control on cost.

Provision for Taxation

Net provision for taxation was at ` 6,616 million for FY 2016-17.

Profit for the year

Profit after tax for the year increased by ` 3,758 million to

` 10,340 million from ` 6,582 million.

Other Comprehensive income

Other comprehensive income comprises of re-measurement

of defined benefit obligation and fair value changes of equity

instruments through other comprehensive income net of income tax

thereon. The figures for current year are ` 123 million vis-à-vis ` 56

million for previous year.

B. FINANCIAL POSITION

Non-Consolidated Financial Position as on 31 March, 2017 as

compared to 31 March, 2016.

Property, plant and equipment, investment property, capital

work-in-progress and intangible assets

During the year, addition to the Company’s block of assets (other than

CWIP) is ` 948 million. This is mainly on account of purchase of plant

and machinery and computer equipments. The capital expenditure is

mainly funded out of internal accruals.

This is partially offset by depreciation / amortisation for the year.

Capital Work-in-Progress increased by ` 524 million to ` 987 million

as on 31 March, 2017.

Non-Current Investments

Non-current Investments have decreased from ` 17,942 million as

on 31 March, 2016 to ` 11,364 million as on 31 March, 2017. The

decrease is mainly on account of certain investments reclassified as

current investments based on maturity.

Current Assets

Current Assets mainly represent Current Investment, Inventories,

Trade Receivables, Cash & Bank Balances, Loans, Other Financial

Assets, and Other Current Assets. The increase in current assets by

` 18,080 million from ` 35,274 million to ` 53,354 million is mainly

attributable to increase in current investment by ` 11,629 million, increase in inventories by ` 2,356 million and other current assets by

` 2,627 million and balance on account of others.

Inventories

Programmes and film rights held by the Company increased by

` 2,356 million from ` 13,366 million as on 31 March, 2016 to

` 15,722 million as on 31 March, 2017.

Current Investment

Current Investment has increased by ` 11,629 million to ` 15,029

million as on 31 March, 2017 from ` 3,400 million as on 31 March,

2016. This is mainly due to certain investments being reclassified

as current investments based on maturity and additional short-term

investments in mutual funds.

Trade Receivables

Trade receivables net of provision for bad and doubtful debts stood

at ` 9,801 million in FY 2017 as against ` 9,539 million in FY 2016.

The age of net debtors is 73 days of sales in FY 2017 as against 83

days of sales in FY 2016.

Cash and Bank Balances

The cash and bank balances lying with the Company, as on

31 March, 2017 was ` 5,431 million as against ` 3,851 million on

31 March, 2016.

Loans and Advances (Current)

Loans have decreased to ` 1,542 million from ` 1,750 million on

account of repayment.

Other current assets

Other current assets have increased by ` 2,627 million, from

` 2,432 million on 31 March, 2016 to ` 5,059 million on 31 March,

2017 mainly on account of operational advances given during

the year.

Share Capital

There is no change in the Paid-up Equity Share Capital of the

Company. The Paid-up Equity Share Capital of the Company as at

31 March, 2017 stands to ` 960 million.

Borrowings

Borrowings represent non-current portion of fair value of redeemable

preference shares (RPS) and vehicle loans. Vehicle loan funds as on

31 March, 2017 stood at ` 8 million, down from ` 9 million. RPS

aggregates ` 15,262 million in current year vis-à-vis ` 17,140 million in previous year. This is on account of reclassification of

current maturity of RPS transferred to current liabilities of ` 3,815

million.

Non-current provisions

Non-current provisions pertain to retirement benefits, and have

marginally increased from ` 411 million as on 31 March, 2016 to

` 441 million as on 31 March, 2017.

Current Liabilities and Provisions

Current Liabilities and Provisions mainly represents Trade Payables,

Statutory Dues, Unearned revenue, provisions and other payables etc.

The same has increased by ` 6,200 million to ` 14,496 million as

on 31 March, 2017 from ` 8,296 million as on 31 March, 2016. The

increase is mainly attributable to reclassification of current maturity

of redeemable preference shares of ` 3,815 million and increase in

trade payables by ` 1,233 million.

CONSOLIDATED

FINANCIALS

A. RESULTS OF OPERATIONS

We have provided a comparison between Audited figures for FY 2017

and FY 2016. The financial results includes share of associates and

joint ventures based on equity accounting.

REVENUE

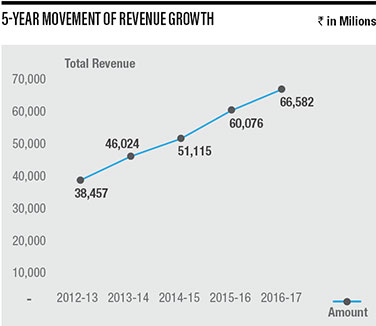

Total revenue increased by ` 6,506 million, or 11% from ` 60,076

million in FY 2016 to ` 66,582 million in FY 2017 on account of

revenue growth across businesses.

Revenue from Operations

The Company’s operating revenue increased by ` 6,217 million or

11%, from ` 58,125 million in FY 2016 to ` 64,342 million in

FY 2017.

Advertising revenues witnessed a growth of ` 3,083 million (9%),

from ` 33,652 million in 2016 to ` 36,735 million in 2017.

Subscription Revenue increased by ` 2,050 million (10%), from

` 20,579 million in FY 2016 to ` 22,629 million in FY 2017.

Other operating income includes syndication and sale of sports

rights, programmes and film rights, commission on space selling etc.

which has increased by ` 1,084 million (28%) to ` 4,978 million in

FY 2017 from ` 3,894 million in FY 2016.

Other Income

Other income increased by ` 289 million (15%) from ` 1,951 million

in FY 2016 to ` 2,240 million in FY 2017. Increase in other income

is mainly on account of interest received.

Expenditure

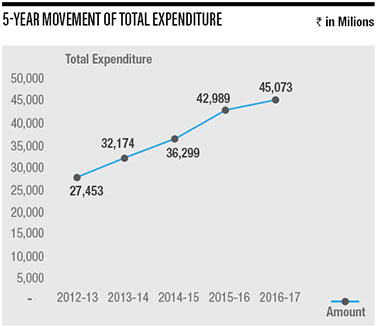

Total operational expenditure increased by ` 2,084 million (5%),

from ` 42,989 million to ` 45,073 million. This increase in cost is

attributable to higher content costs.

Operational Cost / Cost of Goods

Operational cost has increased by ` 1,841 million (7%) to ` 27,825

million in FY 2017 as against ` 25,984 million in FY 2016. The

overall increase in operational cost is mainly attributable to increase

in cost of amortisation of programming and film content.

Employee Benefit Expenses

Employee cost increased by ` 1,057 million, or 21%, from ` 4,986

million in FY 2016 to ` 6,043 million in FY 2017.

Other expenses

Administrative and other expenses decreased by ` 814 million (7%),

from ` 12,019 million in FY 2016 to ` 11,205 million in FY 2017.

The reduction is mainly on account of marketing and distribution

expense.

Operating Profit

The Company’s operating profit increased by ` 4,133 million (27%),

from ` 15,136 million in FY 2016 to ` 19,269 million in FY 2017.

The operating margin is at 30% for FY 2017. The increase in

operating profit is mainly attributable to increase in revenue during

the year coupled with optimisation in operating costs.

Finance Costs

Finance costs decreased by ` 226 million (14%) from ` 1,598

million to ` 1,372 million.

Depreciation and Amortisation

Depreciation increased by ` 375 million (48%), from ` 777 million

in FY 2016 to ` 1,152 million in FY 2017. Increase is mainly on

account of depreciation on additions during the year.

Fair value loss on financial instruments at fair value through profit and loss is mainly on account of fair valuation of redeemable preference shares and fair value change in financial instruments.

Exceptional item for the current year represents gain on sale of major part of sports broadcasting business alongwith transfer of entire equity stake held in wholly owned subsidiary viz. Taj Television (India) Private Limited.

Profit before Tax

Profit before tax increased by ` 15,281 million or 111% from

` 13,728 million in FY 2016 to ` 29,009 million in FY 2017. The

current and previous year’s figures are not comparable on account of

exceptional item.

Provision for Taxation

Provision for taxation increased by ` 1,313 million, to ` 6,804 million

in FY 2017 from ` 5,491 million in FY 2016.

Profit for the year

Profit for the year increased by ` 13,968 million (170%) to ` 22,205

million from ` 8,237 million. Figures are not comparable on account

of profit generated during the current year from sale of major part of

sports broadcasting business.

B. FINANCIAL POSITION

Consolidated Financial Position as on 31 March, 2017 as compared

to 31 March, 2016.

Property, plant and equipment, Investment Property, Capital Work-in-

Progress and Intangible assets and Intangible assets in progress.

During the year, the additions to the block is of ` 2,418 primarily in

plant and machinery and buildings.

In the current year, the goodwill has reduced ` 6,167 million. This

is mainly on account of derecognition of goodwill relating to sports

business.

Capital work-in-progress increased by ` 166 million to ` 1,270

million as on 31 March, 2017.

Non-current Investments

The increase of ` 4,276 million in non-current investments to

` 11,868 million as at 31 March, 2017 from ` 7,592 million mainly

represents treasury investments.

Non-current assets

The non-current assets consisting of capital advances, income tax

assets, claim receivables and other assets have decreased by

` 117 million to ` 6,992 million in FY 2017 as against ` 7,109

million in FY 2016. The decrease is mainly attributable to decrease

in capital advances by ` 260 million partially offset by marginal

reduction in advance taxes.

Current Assets

There has been an overall increase in current assets by ` 26,708

million, from ` 54,233 million in FY 2016 to ` 80,941 million in

FY 2017.

Inventories

Programmes and film rights held by the Company have increased

from ` 13,180 million on 31 March, 2016, to ` 16,843 million on

31 March, 2017. The increase mainly represents unamortised film

rights and programmes.

Investments

The increase of ` 4,276 million from ` 7,592 million to ` 11,868

million in current year is mainly due to certain investments

reclassified as current investments based on maturity and additional

current investments made during the year.

Trade Receivables

Trade receivables net of provision for bad and doubtful debts stood at

` 13,059 million in FY 2017 as against ` 13,482 million in FY 2016,

reflecting an reduction of ` 423 million. The age of net debtors is 74

days of sales in FY 2017, as against 85 days of sales in FY 2016.

Cash and Bank Balances

The cash and bank balances lying with the Company, as on

31 March, 2017 were ` 26,133 million as against ` 9,631 million on

31 March, 2016 reflecting a strong cash position in the Company.

Other financial assets includes loans, deposits and other assets

aggregating to ` 3,755 million as on 31 March, 2017 vis-à-vis

3,773 million as on 31 March 2016.

Other current assets comprises of trade advances, prepaid expenses,

and indirect taxes aggregating to ` 9,283 million as on 31 March,

2017 vis-à-vis ` 6,575 million as on 31 March, 2016. The increase

is primarily on account of operational advances.

EQUITY AND LIABILITIES

Equity Share Capital

During the year, there is no change in the equity share capital of the

Company.

Borrowings

Borrowings represent non-current portion of fair value of redeemable

preference shares (RPS) and vehicle loans. Vehicle loan funds as

on 31 March, 2017 stood at ` 11 million,down from ` 9 million.

RPS aggregates ` 15,262 million in current year vis-à-vis ` 17,140 million in previous year. This is on account of reclassification of current

maturity of RPS transferred to current liabilities (` 3,815 million).

Long-term Provisions

Long-term provisions consisting of retirement benefits have increased by

` 233 million, from `534 million to ` 767 million as on 31 March,

2017.

Non-Current liabilities

Non-current liabilities represent the advance received towards

syndication of sports content which is Nil for the current year.

Current Liabilities and Provisions

Current liabilities and provisions mainly represent trade payables,

statutory dues, unearned revenue, provisions and other payables etc.

Current liabilities and provisions as on 31 March, 2017 have

increased by ` 4,139 million, at ` 17,750 million as on 31 March,

2017 vis-a-vis ` 13,611 million on 31 March, 2016.

The increase is mainly attributable to reclassification of current

maturity of redeemable preference shares of ` 3,815 million.

RISK FACTORS

EXTERNAL RISK

FACTORS

INDUSTRY RISK

EVER-CHANGING TRENDS IN MEDIA SECTOR

Audience tastes are constantly evolving and difficult to predict with

accuracy. People’s tastes vary quite rapidly along with the trends and

environment they live in. This makes it virtually impossible to predict

whether a particular content would do well or not. With the kind of

investments made in ventures, repeated non-performance of the shows

would have an adverse impact on the bottom-line of the Company.

SLOWDOWN IN DTH / DIGITAL ROLLOUT

The uptake of pay digital services by subscribers has been a very

encouraging sign for all broadcasters. Contrary to the global trends, in

India, the under-declaration in the analogue cable system has led the

broadcasters to be more dependent on advertising revenues, which

tend to be cyclical in nature and more affected by the macroeconomic

factors. Completion of rollout of Phase I and Phase II cities took longer

than expected. Phase III rollout is currently underway. It may take longer

to realise revenues from Phase III and Phase IV cities as their rollouts may

not be completed on time.

COMPETITION FROM OTHER BROADCASTERSS

The Company operates in a highly competitive environment that is subject

to innovations, changes and varying levels of resources available to each

broadcaster in each segment of business. The GEC genre is amongst the

key genres for all advertisers and hence is most lucrative to all the TV

broadcasters. Any new competition in the space can have an impact on

the Company’s revenues.

BUSINESS ENVIRONMENT RISK

MACROECONOMIC ENVIRONMENT

Macroeconomic environment can be a potential source of risk.

Moderating growth, along with high inflation, can adversely impact

advertising revenues of the Company, which forms it’s the largest

component of revenues.

THE COMPANY MAY BE EXPOSED TO FOREIGN EXCHANGE RATE FLUCT

The Company receives a significant portion of its revenues and incurs

a significant portion of its expenses in foreign currencies, particularly

US dollars and UK pounds. Accordingly, the Company is exposed to

fluctuations in the exchange rates between those currencies and the

Rupee, which is the Company’s reporting currency. This may have a

substantial impact on its revenues and expenses.

SLUGGISH CONSUMER UPTAKE IN THE INTERNATIONAL MARKETS

ZEE has been a pioneer in the international markets and has the highest

market share amongst all South Asian broadcasters across Europe and

USA. Indian content in these markets serves the preference of a niche

audience and ZEE has strong relations with distribution platforms in

these markets. This gives the Company the confidence that it will retain

market share in key geographies. Given the global economic slowdown,

consumers may find it difficult to upgrade their packages, and hence

value growth from these markets may get affected.

REGULATORY RISK

UNCERTAINTY IN RULES & REGULATIONS

The M&E industry is governed by the rules and regulations framed by the

Ministry of Information & Broadcasting as well as industry bodies such

as TRAI. The rules such as price regulation have a direct bearing on the

revenue potential of the Company. The existing as well as future rules and

regulations can impact the financial performance of the Company.

INTERNAL RISK

FACTORS

COST OF PROGRAMMING MIX MIGHT AFFECT THE COMPANY’S BOTTOM-LINE

The Company always strives to have a competitive edge by providing

viewers the best possible content. ZEE would have to incur high

expenditure to provide an impetus on its programming and content from

time to time. The resulting increase in costs might not necessarily perk up

its revenues proportionately.

INVESTMENTS IN NEW CHANNELS

The Company may from time to time launch new channels. Content for

these channels is either created or acquired. The success of any new

channel depends on various factors, including the quality of programming,

price, extent of marketing, competition etc. There can be no assurance

that the Company will be as successful in launching new channels as it

has been in the case of its existing channels.

INCREASE IN COST OF CONTENT ACQUISITION

The Company spends a significant amount for acquisition of rights to

telecast sporting events, movies and music rights, and library content

rights. Any future contracts may be at higher costs, which may put

pressure on the Company’s margins.

HUMAN RESOURCE DEVELOPMENT

The real asset of your Company is its People. Apart from the normal operations related to Human Resources, your Company strives to implement corporate branding practices, succession planning and maintaining a steady flow of talent pipeline. Your Company has 3,000+ employees with favourable demographics. More than 75% of employees are less than 40 years of age and on average the employees have been there with the Company for more than 4 years.

The Company’s people philosophy SAMWAD has helped focus on creating great managers and making ZEE a great place to work. SAMWAD monthly conversations gives an opportunity to employees to interact with their managers and explore new initiatives. This not only helps employees to enhance their entrepreneurial spirit but also helps them to track their monthly performance and get constructive feedback.

During the year, your Company achieved the certification as a Great Place to Work® by the Great Place to Work® Institute, India. Based on this framework, it was revealed that Zee Entertainment had significantly positive employee perception and robust people practices, which identified it as an organisation with a Great Culture.

INTERNAL CONTROL & VIGIL MECHANISM

The Company’s internal control systems are commensurate with the nature of its business and the size and complexity of its operations. These are routinely tested and certified by Statutory as well as Internal Auditors and cover key business areas. Significant audit observations and follow up actions thereon are reported to the Audit Committee. The Audit Committee reviews adequacy and effectiveness of the Company’s internal control environment and monitors the implementation of audit recommendations, including those relating to strengthening of the Company’s risk management policies and systems.